Forex Trading Futures

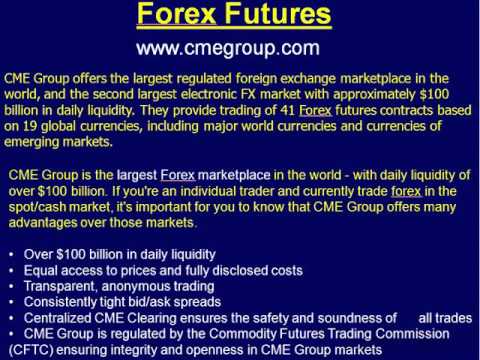

Currency futures markets have a great deal more oversight that the spot forex markets, which are at times criticized for things like non-centralized pricing and forex brokers trading against their. Forex. com is a registered fcm and rfed with the cftc and member of the national futures association (nfa 0339826). forex trading involves significant risk of loss and is not suitable for all investors. full disclosure. spot gold and silver contracts are not subject to regulation under the u. s. commodity exchange act. Forextrading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on.

Futures & futures options diversify your forex trading through the small exchange and trade with the efficiencies of futures and the simplicity of stocks. the small exchange offer standardized futures products that are small, standard and simple across indices made up of some of the most traded and liquid underlying assets. Currency futures vs. spot fx: an overview. the foreign exchange market is a very large market with many forex trading futures different features, advantages, and pitfalls. forex investors may engage in trading currency.

Forex futures can be traded live, though an open cry-out system. many exchanges have already phased out this option, however. the most straightforward way to trade forex futures is through electronic means, on the internet. forex futures represent just another way to trade currencies. investors can trade forex through: the spot market. forex. The competition among spot forex brokers is so fierce that you will most likely get the best quotes and very low transaction costs. price certainty. when trading forex, you get rapid execution and price certainty under normal market conditions. in contrast, the futures and equities markets do not offer price certainty or instant trade execution. Coverage of post-market trading including futures information for the s&p, nasdaq and nyse.

Forex Futures Definition Investopedia

1 minute review. ninjatrader is a powerful derivatives trading platform specializing in futures, forex and forex trading futures options. the platform has a number of unique trading tools. Mar 16, 2020 · forex trading in the spot market has always been the largest market because it is the "underlying" real asset that the forwards and futures markets are based on. In order for your swing trading strategies to be workable, it must give you an edge. swing trading futures is the only multisession system on our futures trading toolbox. while swing trading stock and forex are more popular, futures are also suitable for swing trading.

Why Trade Forex Forex Vs Futures Babypips Com

Most people think of the stock market when they hear the term "day trader," but day traders also participate in the futures and foreign exchange (forex) markets. (some day traders buy or sell options, but traders who focus on the options market are more likely to be swing traders, who hold positions for days or weeks, not fractions of a single trading day. ). Forex futures: a forex future is an exchange-traded contract to buy or sell a specified amount of a given currency at a predetermined price on a set date in the future. all forex futures are. Trading forex futures, much like any speculative activity, is risky in nature. the trader must at least have a passing knowledge of technical and macroeconomic analysis and understand a contract. 2 24-hour market. another remarkable difference between forex vs futures trading is the fact that the forex market operates a seamless 24-hour market. from monday to friday, forex traders have uninterrupted access to make instant trades on the forex market based on valuable information or market indicators that may affect the value of any currency.

Futures trading-forex invincible signal is a non-repaint indicator. you can use this template for any currency pairs & any time frames. also, you forex trading futures can use this indicator for commodities. the indicator shows mt4 account information in the upper corner. A december 2017 greenwich associates study assessed the value and viability of fx futures as a proxy for otc fx and found that, in certain circumstances, fx futures can generate upwards of 75% savings* over otc fx markets. economic benefits of using futures. Forex. com is a registered fcm and rfed with the cftc and member of the national futures association (nfa 0339826). forex trading involves significant risk of loss and is not suitable for all investors.

Nov 12, 2019 · most people think of the stock market when they hear the term "day trader," but day traders also participate in the futures and foreign exchange (forex) markets. (some day traders buy or sell options, but traders who focus on the options market are more likely to be swing traders, who hold positions for days or weeks, not fractions of a single trading day. ). Tradingfutures vs forex. pros of forex trading. 1leverageprofit chances are high because it forex trading futures provides access to high leverage positions. 2-more opportunitiesforex trading only closes on saturdays and sundays and remains 24/7 open in other weekdays, increases the trading opportunities.

Belum ada Komentar untuk "Forex Trading Futures"

Posting Komentar